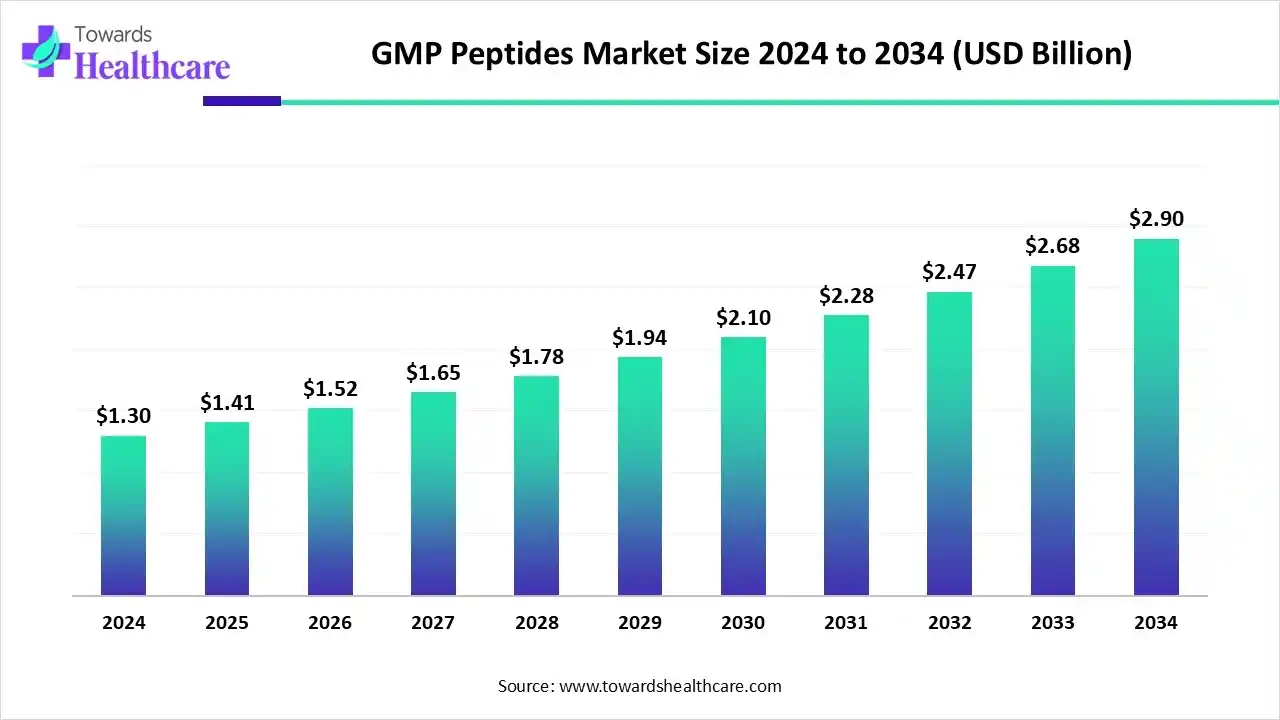

GMP Peptides Market to Reach USD 2.9 Billion by 2034 | CAGR 8.35% Forecast

The global GMP peptides market size was valued at USD 1.3 billion in 2024 and is predicted to hit around USD 2.9 billion by 2034, rising at a 8.35% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 10, 2025 (GLOBE NEWSWIRE) -- The global GMP peptides market size is calculated at USD 1.41 billion in 2025 and is expected to reach around USD 2.9 billion by 2034, growing at a CAGR of 8.35% for the forecasted period.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/6353

Key Takeaways

- The GMP peptides sector pushed the market to USD 1.3 billion by 2024.

- Long-term projections show a USD 2.9 billion valuation by 2034.

- Growth is expected at a steady CAGR of 8.35% in between 2025 to 2034.

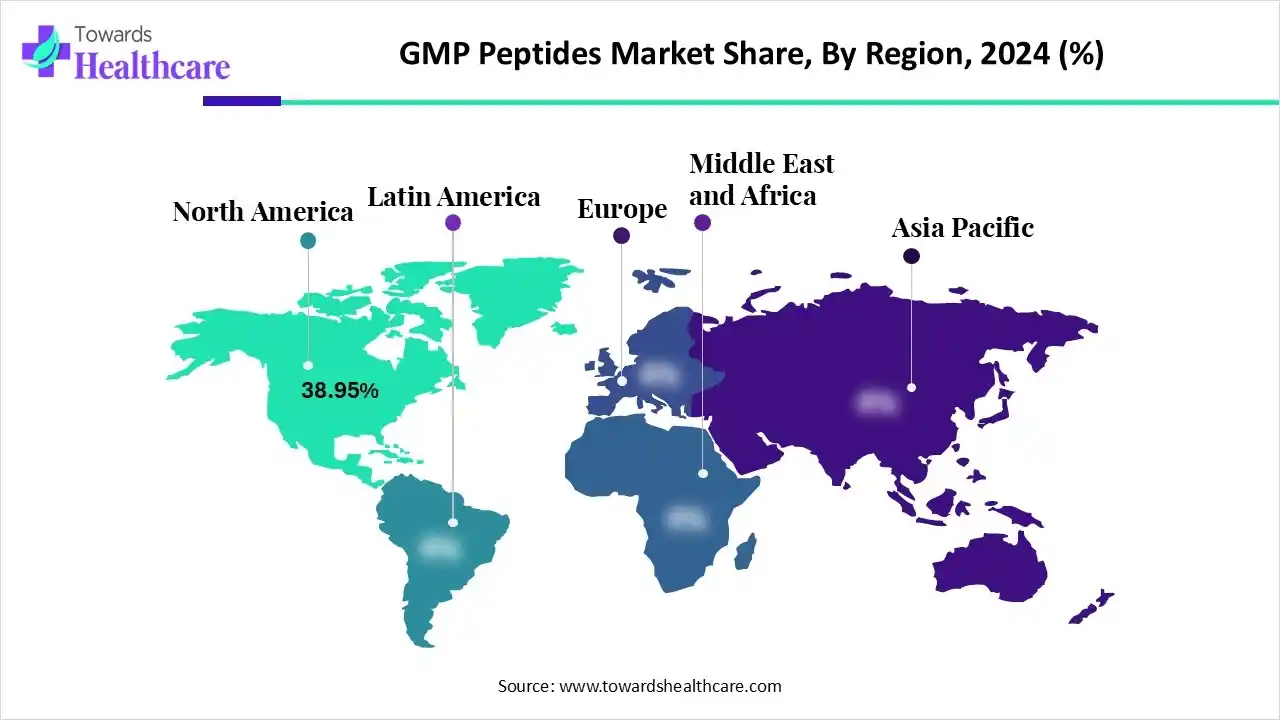

- North America was dominant in the market in 2024.

- Asia-Pacific is expected to grow fastest in the studied years.

- By type, the innovative peptides segment held a major share of the market in 2024.

- By type, the peptide-drug conjugates segment is expected to grow at a rapid CAGR during 2025-2034.

- By synthesis method, the solid-phase peptide synthesis (SPPS) segment led the GMP peptides market in 2024.

- By synthesis method, the hybrid/mixed-phase synthesis segment is expected to witness rapid expansion in the upcoming years.

- By service type, the API development & manufacturing segment dominated the market in 2024.

- By service type, the formulation development segment is expected to grow rapidly in the predicted timeframe.

- By application area, the oncology treatments segment registered dominance in the market in 2024.

- By application area, the diagnostic applications segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use, the pharmaceutical companies segment held the dominating share of the market in 2024.

- By end-use, the CDMOs & CROs segment is expected to register the fastest growth in the coming years.

What are the Prominent Ongoing Expansions & Advances in the GMP Peptides?

Specifically, peptides that are manufactured by complying with Good Manufacturing Practice (GMP) regulations, a stringent set of quality standards mandated by regulatory bodies, especially the FDA and EMA, are supporting the GMP peptides market. This assistance is mainly propelled by persistent advances in synthesis technology, rising R&D investment, and growth into emerging markets. Recently, CordenPharma, Sai Life Sciences, and BioDuro made investments in new facilities, with escalating capabilities to meet the increasing demand.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Significant Drivers Involved in the Market Progression?

A major catalyst is the benefits of peptides, such as their high specificity and minimal toxicity as compared to conventional drugs, making them suitable for innovative drug development. Besides this, the GMP peptides market is impacted by the expansion of tailored medicine, as well as growing reliance on CDMOs by different pharmaceutical companies for peptide production, with a substantial contribution of specialised professionals.

What are Key Drifts in the GMP Peptides Market?

- In November 2025, PeptiSystems secured a major expansion equity investment from Rubicon Healthcare Partners, for pivotal growth of its commercial presence and to scale its advanced manufacturing technologies for peptide and oligonucleotide therapeutics.

- In October 2025, Ajinomoto Bio-Pharma Services, a major provider of biopharmaceutical contract development and manufacturing services, and Olon S.p.A. partnered to offer Aji Bio-Pharma's microbial CORYNEX peptide and protein manufacturing platform and Olon's large-scale microbial fermentation capabilities.

- In April 2025, CordenPharma invested more than EUR 1 billion ($1.1-billion) in peptide development and manufacturing.

What is the Major Challenge in the GMP Peptides Market?

Many companies are facing limitations to ensure consistent purity, manage impurities, and the increased spending and solvent usage of synthesis methods, mainly for longer peptides. Sometimes, they may have restrictions on harmonized international standards, resource provision for compliance.

Regional Analysis

How did North America Capture a Major Share of the Market in 2024?

In 2024, North America led the market with the largest share, due to the rising R&D investment in biologics. As well as the region is also fostering the development of biologics, cell therapies and gene therapies, which raises the demand for specialized GMP manufacturing platforms for peptides. Recently, Zealand Pharma initiated Dapiglutide in Phase 2 trials and Petrelintide, an amylin-based product candidate, in Phase 2 clinical trials.

For instance,

- In October 2025, Amino Vault, a U.S.-based supplier of research peptides and reagents, launched AminoVault.com, a next-generation marketplace built for laboratory research use only (RUO) materials.

Why did the Asia Pacific Expand Significantly in the GMP Peptides Market in 2024?

In the prospective period, the Asia Pacific is anticipated to register the fastest growth in the market. Nowadays, the ASAP is leveraging government-led initiatives and the development of biotech clusters, mainly in South Korea, Singapore, and Japan are further promoting the overall expansion. Whereas Australia and Taiwan are facilitating robust academic research and research grants for future progression.

For instance,

- In November 2025, Fujifilm unveiled joint research with the National Cancer Center in Japan to show targeted nucleic acid delivery using proprietary cyclic peptides.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Company Overview in the GMP Peptides Market

| Company | Headquarters | Notable Efforts |

| PolyPeptide Group AG | Neuhofstrasse 24, 6340 Baar, Switzerland. | In October 2025, the company collaborated with Lifecore Biomedical to offer an end-to-end peptide manufacturing solution for the U.S. market. |

| Bachem | Bubendorf, Switzerland. | In May 2025, Peptide and oligonucleotide manufacturer Bachem planned to upgrade its current production facilities in Bubendorf, Switzerland, St Helens, UK and Vista, California. |

| CPC Scientific | Rocklin, California. | In October 2025, CPC Scientific demonstrated peptide and oligonucleotide CDMO leadership at CPHI Frankfurt 2025. |

| CordenPharma | Basel, Switzerland. | In March 2025, it expanded its peptide platform with more than 500 million euros in Greenfield facility construction in the Basel region of Switzerland. |

| AmbioPharm | North Augusta, South Carolina, USA. | It raised $28 million expansion of its Shanghai facility online in the second half of 2025. |

Segmental Insights

By type analysis

Which Type Dominated the GMP Peptides Market in 2024?

In 2024, the innovative peptides segment captured the biggest share of the market. These peptides mainly focus on target cancer cells to deliver a potent drug payload with minimised systemic toxicity as compared to traditional chemotherapy. Significant examples include BT8009, a bicyclic peptide in Phase I/II clinical trials for metastatic urothelial cancer, and Enlicitide (MK-0616), an orally bioavailable PCSK9 inhibitor in Phase III clinical trials for hypercholesterolemia.

Whereas the peptide-drug conjugates segment will expand rapidly. The segment is mainly fueled by a rise in adoption of solid-phase peptide synthesis (SPPS) with its rapid and more affordability in development and scale-up of PDCs. Also, they have broader applications beyond cancers, such as viral infections and metabolic disorders. Current transformative new drugs into clinical trials, especially CBP-1008, a dual-targeted conjugate for solid tumours, and MB1707, a CXCR4-targeted agent, are impacting the future progression.

By synthesis method analysis

What Made the Solid-Phase Peptide Synthesis (SPPS) Segment Dominant in the Market in 2024?

The solid-phase peptide synthesis (SPPS) segment held the biggest share of the GMP peptides market in 2024. Substantial advantages of this method are speed, ease of purification, and scalability, as well as enabling the incorporation of non-natural amino acids, modifications, and complex sequences. Nowadays, the globe is exploring aqueous SPPS (ASPPS), which continues SPPS entirely in aqueous media using standard Fmoc-protected amino acids and hydrophilic resins, resulting in a scalable and eco-friendly approach.

During 2025-2034, the hybrid/mixed-phase synthesis segment is predicted to expand fastest. This approach primarily supports producing small, protected peptide segments using SPPS, with subsequent purification and combining together in a solution phase (LPPS) to form the full, long peptide chain. Currently, the worldwide researchers are stepping towards straightforward and scalable solution-phase flow conditions using in-situ activation as mixed anhydrides to develop peptide bonds.

By service type analysis

Which Service Type Led the GMP Peptides Market in 2024?

The API development & manufacturing segment accounted for the dominating share of the market in 2024. The segmental growth is specifically driven by the adoption of fully automated synthesis platforms to boost effectiveness, lower batch-to-batch variability, improve synthesis conditions, and push the drug discovery process. Also, they are leveraging the combined advantages of solid-phase peptide synthesis (SPPS) for purity and liquid-phase peptide synthesis (LPPS) for scalability, especially for complex and long-chain peptides.

However, the formulation development segment is estimated to register rapid expansion. Persistent developments are emphasizing oral formulations, lipid-based delivery systems, and sustained-release formulations. Alongside, the significant players are widely using permeation enhancers, such as salcaprozate sodium (SNAC), for further support of open tight junctions in the intestinal lining to raise absorption of oral peptides. The latest development encompasses Enlicitide (MK-0616), an oral macrocyclic peptide PCSK9 inhibitor currently in Phase III trials, used in the treatment of high cholesterol.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By application area analysis

How did the Oncology Treatments Segment Dominate the Market in 2024?

In 2024, the oncology treatments segment held the biggest share of the GMP peptides market. Different peptides have versatility in oncology, such as targeted therapy, hormonal therapy, and as carriers for cytotoxic agents or radioisotopes. Specific examples of peptide analogues, like Goserelin (Zoladex), Leuprolide (Lupron), and Triptorelin (Trelstar), are increasingly employed in androgen deprivation therapy for prostate cancer and breast cancer by modulating GnRH receptors.

On the other hand, the diagnostic applications segment is predicted to expand rapidly during 2025-2034. Primarily, these peptides have broader use in molecular imaging techniques, including Positron Emission Tomography (PET) and Single-Photon Emission Computed Tomography (SPECT) as targeting agents. In 2025, scientists have explored the application of targeting peptides as recognition elements in nano-sensors or fluorescence detection platforms for the detection of early-stage AD biomarkers in the blood.

By end-use analysis

How did the Pharmaceutical Companies Segment Lead the Market in 2024?

The pharmaceutical companies segment was dominant in the GMP peptides market in 2024. Majorly, Bachem, PolyPeptide Group, CordenPharma, and Merck KGaA, as well as Amgen, Novo Nordisk, Eli Lilly, Sanofi, and Takeda, are increasingly fostering peptide development. A major step was taken in early 2025 is Pepticom's Series A1 to advance AI-enabled peptide drug discovery.

Although the CDMOs & CROs segment is predicted to expand rapidly during 2025-2034. A prominent support by CDMOs in managing both development and manufacturing, whereas CROs are emphasising research and clinical trials, is impacting the global expansion. Nowadays, these facilities are bolstering the adoption of AI and automation for process enhancement, part of the "Peptide CDMO 2.0" trend.

What are the Revolutionary Developments in the GMP Peptides Market?

- In December 2025, Sapu Nano, a clinical-stage nanomedicine company, launched its proprietary Deciparticle platform, which enables the formulation of macrolide mTOR inhibitors, cyclic peptides, linear peptides, ascomycin macrolactams, and polyketides.

- In December 2025, Instamed Philippines launched a new range of Oral Dissolving Peptides created for individuals looking for a simple, non-invasive way.

- In May 2025, ProteinQure raised $11-million in Series A funding to introduce a first-in-human study of its potentially first-in-class peptide-drug conjugate (PDC).

Browse More Insights of Towards Healthcare:

The global peptide therapeutics market size is calculated at US$ 49.17 billion in 2024, grew to US$ 51.81 billion in 2025, and is projected to reach around US$ 81.5 billion by 2034. The market is expanding at a CAGR of 5.35% between 2025 and 2034.

The peptide-based weight loss medication market is experiencing significant expansion, with projections indicating a revenue increase reaching several hundred million dollars by the end of the forecast period, spanning 2025 to 2034.

The global peptide receptor radionuclide therapy market size is estimated at US$ 2.34 billion in 2024, is projected to grow to US$ 2.58 billion in 2025, and is expected to reach approximately US$ 6.1 billion by 2034.

The global peptide synthesis market size is calculated at USD 686.59 million in 2024, grew to USD 774.06 million in 2025, and is projected to reach around USD 2277.59 million by 2034. The market is expanding at a CAGR of 12.74% between 2025 and 2034.

The global biosynthesis peptide drugs market size is estimated at US$ 18.31 billion in 2024, is projected to grow to US$ 19.45 billion in 2025, and is expected to reach around US$ 32.88 billion by 2034. The market is projected to expand at a CAGR of 6.26% between 2025 and 2034.

The global chemical synthesis peptide drugs market size is calculated at US$ 2.57 billion in 2024, grew to US$ 2.74 billion in 2025, and is projected to reach around US$ 4.82 billion by 2034. The market is expanding at a CAGR of 6.54% between 2025 and 2034.

The global collagen and gelatin market size is calculated at USD 1.25 billion in 2024, grow to USD 1.32 billion in 2025, and is projected to reach around USD 2.2 billion by 2034.The market is expanding at a CAGR of 5.84% between 2025 and 2034.

The global oral proteins & peptides market size is calculated at US$ 8.05 billion in 2024, grew to US$ 9.36 billion in 2025, and is projected to reach around US$ 36.35 billion by 2034. The market is expanding at a CAGR of 16.34% between 2025 and 2034.

GMP Peptides Market Key Players Lists

- PolyPeptide Group AG

- Bachem

- CPC Scientific

- CordenPharma

- AmbioPharm

- ScinoPharm/ScinoPharm Taiwan

- Lonza Group

- Thermo Fisher Scientific (Patheon)

- Catalent

- GenScript Biotech

- Almac Group

- Asymchem

- Peptide Institute

- JPT Peptide Technologies

- CSBio

- BCN Peptides

- AnaSpec

- Senn Chemicals (Senn)

- Piramal Pharma Solutions

- Peptide 2.0

Segments Covered in the Report

By Type

- Innovative Peptides

- Peptide-Drug Conjugates

- Generic Peptides

- Modified Peptides

By Synthesis Method

- Solid-Phase Peptide Synthesis (SPPS)

- Hybrid/Mixed-Phase Synthesis

- Liquid-Phase Peptide Synthesis (LPPS)

- Recombinant Peptide Production

By Service Type

- API Development & Manufacturing

- Formulation Development

- Fill-Finish Services

- Analytical & Quality Control Services

By Application Area

- Oncology Treatments

- Diagnostic Applications

- Diabetes Treatments

- Cardiovascular Therapies

- Neurological Disorders

- Infectious Diseases

- Cosmetic/Personal Care Applications

By End-Use

- Pharmaceutical Companies

- CDMOs & CROs

- Biotechnology Companies

- Academic & Research Institutes

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/6353

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.