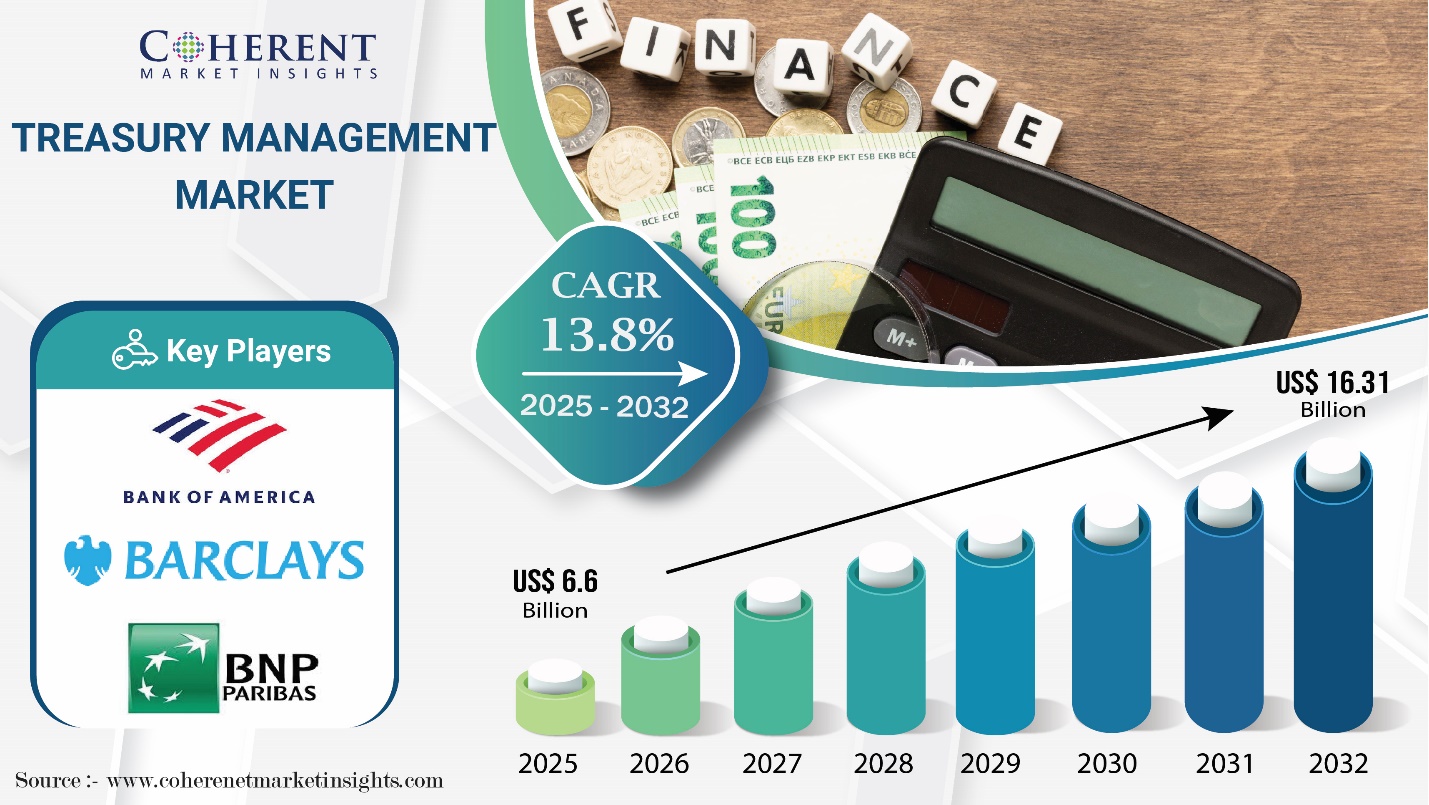

Treasury Management Market Size to Hit USD 16.31 Billion by 2032, says Coherent Market Insights

Burlingame, CA, Oct. 07, 2025 (GLOBE NEWSWIRE) -- The Global Treasury Management Market is estimated to be valued at USD 6.6 Bn in 2025 and is expected to reach USD 16.31 Bn in 2032, exhibiting a compound annual growth rate (CAGR) of 13.8% from 2025 to 2032. Several factors are fueling the growth of the global treasury management market, including the rising complexity of treasury operations, the increasing need for enhanced efficiency and control, and the growing demand for real-time financial information.

Request Sample Report: https://www.coherentmarketinsights.com/insight/request-sample/6115

Global Treasury Management Market Key Takeaways

According to Coherent Market Insights (CMI), the global treasury management market size is expected to grow nearly 2.5X between 2025 and 2032, reaching USD 16.31 Bn by 2032, up from USD 6.6 Bn in 2025.

Global demand for treasury management software and services is poised to rise at a CAGR of 13.8% from 2025 to 2032.

Software segment is projected to account for 65% of the global treasury management market share by 2025.

North America, with an estimated share of 35% in 2025, is anticipated to retain its dominance over the global treasury management industry.

Europe is expected to remain the second-leading market for treasury management solutions, capturing 25% of the global market share by 2025.

Asia Pacific is set to emerge as the most lucrative market for treasury management companies during the forecast period.

Increasing Complexity of Financial Operations Fueling Market Growth

Coherent Market Insights’ latest treasury management market analysis outlines key factors spurring industry growth. One such prominent growth driver is the increasing complexity of financial operations.

Businesses in the modern world are continuously expanding, leading to increased complexity of financial operations. This is where treasury management solutions set in.

Treasury management solutions help companies automate and streamline their financial operations by managing cash flow, assets, liabilities, and investments. They are designed to handle multi-currency, compliance, and tax-related complexities.

As the complexity of global financial operations increases, so will treasury management demand. Similarly, rising need for advanced treasury tools is expected to boost growth of the target market in the coming years.

Immediate Delivery Available | Buy This Premium Research Report: https://www.coherentmarketinsights.com/insight/buy-now/6115

High Implementation Costs and Data Security Concerns Limiting Market Growth

The global treasury management market outlook looks bright. However, high implementation costs and rising data security concerns might limit market growth during the assessment period.

Automated treasury management solution can be expensive, particularly for small and medium-sized businesses (SMEs). This may reduce overall treasury management market demand during the forecast period.

In addition, treasury management solutions deal with sensitive financial information, which makes them targets for hacks, cyberattacks, and misuse of data. These security risks could slow down the treasury management market growth during the forthcoming period.

Ongoing Digital Transformation Driving Growth

The global push for digital transformation is creating a fertile ground for the expansion of treasury management market. Companies around the world are increasingly moving from manual, paper-based treasury operations to digital solutions. This shift helps businesses manage cash, payments, liquidity, and financial risks more efficiently.

Treasury management software and services play a key role in this transformation. They allow organizations to automate processes, gain real-time visibility into finances, and make smarter, faster decisions. As more companies adopt these digital tools, the treasury management market is expected to see strong growth and new business opportunities.

Emerging Treasury Management Market Trends

Rising need for liquidity and cash flow visibility is expected to drive growth of the treasury management market. Modern businesses are increasingly focusing on real-time monitoring of cash positions, working capital, and liquidity to enhance financial stability. This trend is encouraging widespread adoption of treasury management solutions.

Cloud-based treasury management solutions are gaining popularity in the contemporary world. This is because they offer advantages like scalability, flexibility, easier integration, and cost efficiency.

Increasing regulatory requirements will likely boost demand for treasury management software and services during the forthcoming period. Evolving financial regulations like Basel III are pushing businesses to adopt advanced treasury management tools for compliance and risk mitigation.

Growing cybersecurity concerns are prompting companies to develop secure and advanced treasury management solutions with enhanced fraud detection and prevention capabilities. These innovations will likely support market expansion in the coming years.

Advanced technologies like AI and ML are being used in treasury solutions to provide advanced capabilities like accurate cash flow forecasting and automating tasks like FX hedging. These innovations are expected to make treasury management solutions more attractive.

Request For Customization: https://www.coherentmarketinsights.com/insight/request-customization/6115

Analyst’s View

“The global treasury management industry is set for robust expansion, owing to increasing complexity of financial operations, growing need for liquidity and cash flow visibility, ongoing digital transformation, and rising adoption of cloud-based solutions, said a senior analyst at CMI.

Current Events and Their Impact on the Treasury Management Market

| Event | Description and Impact |

| Adoption of AI and Automation in Treasury |

|

| Digital Currency and Payment Infrastructure Evolution |

|

| Cloud and SaaS Migration |

|

Competitor Insights

Key companies in the treasury management market report:

- BNP Paribas, Citigroup Inc.

- Morgan Stanley

- Deutsche Bank AG

- Standard Chartered

- Barclays Bank PLC

- Goldman Sachs, J. P. Morgan Chase & Co.

- Bank of America Corporation

- Wells Fargo

- THE BANK OF NEW YORK MELLON CORPORATION

- The PNC Financial Services Group, Inc.

- U.S. Bank

- East Point Asset Management Limited

- UBS

Key Developments

In April 2025, FIS launched Treasury and Risk Manager – Quantum Cloud Edition, its next-generation enterprise treasury and risk management platform. This new solution supports increased workloads, larger transaction volumes, and greater enterprise connectivity.

In December 2024, SUNRATE launched new treasury solutions (Trading and Hedging) aimed at helping businesses with foreign exchange trading, risk strategies, and related tools. These novel solutions will empower customers to access all their trading and hedging needs in one place.

Global Treasury Management Market Detailed Segmentation:

By Component:

- Software

- Cash Flow Management Software

- Risk Management Software

- Liquidity Management Software

- Payment Management Software

- Debt and Investment Management Software

- Services

- Consulting and Advisory Services

- Implementation and Integration Services

- Support and Maintenance Services

By Deployment Mode:

- On-Premises

- Cloud-Based

- By Enterprise Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By End-Use Industry:

- IT and Telecom

- BFSI

- Retail

- Healthcare

- Government & Public Sector

- Manufacturing

- Others (Consumer Goods, Energy and Utilities and Others)

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East &Africa

Related Reports:

Contract Lifecycle Management Software Market Outlook for 2025-2032Entity Management Software Market Size, Share, Trends & Opportunities for 2025-2032

Tax Management Software Market Analysis & Forecast for 2025-2032

Our Trusted Partners:

Worldwide Market Reports, Coherent MI, Stratagem Market Insights

Get Recent News:

https://www.coherentmarketinsights.com/news

About Us: Coherent Market Insights leads into data and analytics, audience measurement, consumer behaviors, and market trend analysis. From shorter dispatch to in-depth insights, CMI has exceled in offering research, analytics, and consumer-focused shifts for nearly a decade. With cutting-edge syndicated tools and custom-made research services, we empower businesses to move in the direction of growth. We are multifunctional in our work scope and have 450+ seasoned consultants, analysts, and researchers across 26+ industries spread out in 32+ countries. Contact Us: Mr. Shah Coherent Market Insights 533 Airport Boulevard, Suite 400, Burlingame, CA 94010, United States US: + 12524771362 UK: +442039578553 AUS: +61-8-7924-7805 India: +91-848-285-0837 Email: sales@coherentmarketinsights.com Website: https://www.coherentmarketinsights.com For Latest Update Follow Us: LinkedIn | Facebook | Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.