Fabry Disease Market to Grow Rapidly During the Study Period (2020–2034) | DelveInsight

The Fabry disease market is growing due to rising prevalence and better diagnostics. While ERTs and GALAFOLD dominate, emerging gene therapies and new treatments show promise. However, pediatric treatment gaps and long-term efficacy remain challenges. Innovation and improved access will be key to future expansion.

New York, USA, June 10, 2025 (GLOBE NEWSWIRE) -- Fabry Disease Market to Grow Rapidly During the Study Period (2020–2034) | DelveInsight

The Fabry disease market is growing due to rising prevalence and better diagnostics. While ERTs and GALAFOLD dominate, emerging gene therapies and new treatments show promise. However, pediatric treatment gaps and long-term efficacy remain challenges. Innovation and improved access will be key to future expansion.

DelveInsight’s Fabry Disease Market Insights report includes a comprehensive understanding of current treatment practices, emerging Fabry disease drugs, market share of individual therapies, and current and forecasted Fabry disease market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the Fabry Disease Market Report

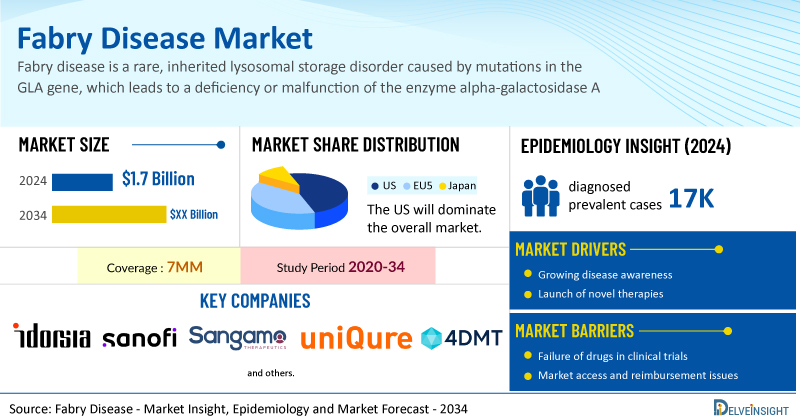

- According to DelveInsight’s analysis, the total Fabry disease market size in the 7MM was estimated to be nearly USD 1.7 billion in 2024, and it is expected to grow positively by 2034.

- The United States accounted for the highest Fabry disease market size, approximately 52% of the total market size in 7MM in 2024, in comparison to the other major markets, i.e., EU4 countries (Germany, France, Italy, and Spain), and the United Kingdom, and Japan.

- Based on DelveInsight's assessment in 2024, the 7MM had approximately 17K diagnosed prevalent cases of Fabry disease.

- Prominent companies, including Idorsia Pharmaceuticals, Sanofi, Sangamo Therapeutics, UniQure Biopharma, 4D Molecular Therapeutics, and others, are actively working on innovative Fabry disease drugs. These novel Fabry disease therapies are anticipated to enter the Fabry disease market in the forecast period and are expected to change the market.

- Some of the key Fabry disease treatments include GALAFOLD (migalastat), ELFABRIO (PRX-102/pegunigalsidase alfa-Iwxj), FABRAZYME (agalsidase beta), REPLAGAL (agalsidase alfa), Lucerastat, Venglustat (GZ402671), Isaralgagene civaparvovec (ST-920), AMT-191, 4D-310, and others.

- In March 2025, Sangamo Therapeutics mentioned the alignment with the FDA on an accelerated approval pathway for ST-920 in Fabry disease, with a BLA submission expected in the second half of 2025.

- In February 2025, Sangamo Therapeutics announced updated data from the Phase I/II STAAR study evaluating isaralgagene civaparvovec for the treatment of Fabry disease at the 21st Annual WORLD Symposium.

- In February 2025, Amicus Therapeutics announced oral presentations and posters related to migalastat development programs at the 21st Annual WORLD Symposium 2025.

- In the January 2025 annual presentation, Sanofi mentioned that the expected date of regulatory submission for venglustat for Fabry disease is in 2026.

- In the January 2025 presentation, Idorsia Pharmaceuticals mentioned that the company is anticipating the Phase III Open-label Extension (OLE) study results in Q2 2025 and planning the discussion for the regulatory pathway to then be discussed with the US FDA.

Discover which Fabry disease medications are expected to grab the market share @ Fabry Disease Market Report

Fabry Disease Overview

Fabry disease is a rare, inherited lysosomal storage disorder caused by mutations in the GLA gene, which leads to a deficiency or malfunction of the enzyme alpha-galactosidase A. This enzyme is essential for breaking down a fatty substance called globotriaosylceramide (Gb3 or GL-3). When the enzyme is deficient, Gb3 accumulates in the cells of blood vessels, nerves, and organs, leading to progressive damage. Fabry disease symptoms often begin in childhood and may include burning pain in the hands and feet, clusters of small, dark red skin spots, reduced ability to sweat, gastrointestinal issues, and eye abnormalities.

Over time, the disease can cause serious complications such as kidney failure, heart disease, and strokes. Diagnosis involves a combination of enzyme activity assays, genetic testing to identify GLA mutations, and tissue biopsies or imaging to assess organ involvement. Early Fabry disease diagnosis and treatment, often with enzyme replacement therapy (ERT) or chaperone therapy, are critical to managing the disease and slowing its progression.

Fabry Disease Epidemiology Segmentation

The Fabry disease epidemiology section provides insights into the historical and current Fabry disease patient pool and forecasted trends for the 7MM. It helps recognize the causes of current and forecasted patient trends by exploring numerous studies and views of key opinion leaders.

The Fabry disease market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Diagnosed Prevalence of Fabry Disease

- Gender-specific Diagnosed Prevalence of Fabry Disease

- Age-specific Diagnosed Prevalence of Fabry Disease

- Phenotype -specific Diagnosed Prevalence of Fabry Disease

Download the report to understand which factors are driving Fabry disease epidemiology trends @ Fabry Disease Treatment Market

Fabry Disease Treatment Market

Fabry disease treatment involves enzyme replacement therapy (ERT), oral chaperone therapy, and supportive medications such as ACE inhibitors and pain relievers. While ERT helps delay disease progression, comprehensive care, including lifestyle adjustments and preventive strategies, is critical for optimal management.

The treatment landscape features several major pharmaceutical companies. In the U.S., three therapies have received approval: ELFABRIO (Chiesi/Protalix), GALAFOLD (Amicus), and FABRAZYME (Sanofi-Genzyme). Europe currently leads with four approved options, while Japan offers two, REPLAGAL and GALAFOLD, and stands out for introducing agalsidase beta biosimilars, unlike other regions.

ERT remains a cornerstone of therapy, using agalsidase alfa and agalsidase beta to replicate α-Gal A activity and slow disease advancement. FABRAZYME (agalsidase beta), from Sanofi-Genzyme, is administered via IV infusion every two weeks. Since its 2003 FDA approval, it has become available in over 70 countries. The expiration of its patent in Japan has led to biosimilars like agalsidase beta BS (JR-051) from JCR Pharmaceuticals. REPLAGAL (agalsidase alfa), developed by Shire (now Takeda), gained approval in Europe in 2001 and Japan in 2007 but was never approved in the U.S. After facing regulatory issues, Shire withdrew its FDA application in 2012, shifting U.S. patients to alternative therapies. Nonetheless, REPLAGAL remains available in more than 35 countries.

ELFABRIO (pegunigalsidase alfa), a pegylated ERT developed by Chiesi/Protalix, is FDA-approved for Fabry disease. While ERT improves clinical outcomes, challenges such as frequent infusions, difficulties with venous access, risk of infections, and complications in children persist. Additionally, the development of antidrug antibodies (ADAs) can hinder treatment effectiveness. To overcome these barriers, chaperone therapy has emerged as an alternative approach.

Chaperone therapy stabilizes misfolded enzymes, enhancing their proper function and cellular trafficking. It has applications in various lysosomal storage disorders, including Gaucher, Pompe, and Fabry diseases. GALAFOLD (migalastat), approved by the FDA in 2018, is the first oral chaperone therapy for Fabry disease. It targets specific GLA gene mutations, offering benefits to 35–50% of patients by stabilizing α-Gal A and promoting the breakdown of GL-3.

Learn more about the Fabry disease treatment options @ Fabry Disease Drugs

Fabry Disease Emerging Drugs and Companies

The Fabry disease pipeline possesses some drugs in the development stage to be approved in the near future. The emerging landscape holds a diverse range of therapeutic alternatives for treatment, including venglustat (Sanofi (Genzyme)), lucerastat (Idorsia Pharmaceuticals), ST-920 (Sangamo Therapeutics), 4D-310 (4D Molecular Therapeutics), AMT-191 (UniQure) and others, and others in different lines of treatment. The launch of these Fabry disease medications is expected to create a positive impact on the market.

ST-920 is a liver-targeting recombinant AAV 2/6 vector that delivers the human α-galactosidase A cDNA via a one-time intravenous infusion. Its goal is to introduce a functional copy of the α-galactosidase A gene into liver cells, enabling them to produce the active enzyme. ST-920 is being developed as a potentially long-lasting, single-dose therapy for Fabry disease to improve patient outcomes.

In a March 2025 update, Sangamo Therapeutics reported that it had reached an agreement with the FDA on an accelerated approval pathway for ST-920 in Fabry disease, with a Biologics License Application (BLA) submission planned for the second half of 2025.

Venglustat is an investigational oral therapy designed to slow disease progression by blocking the buildup of abnormal glycosphingolipids. It works by inhibiting the conversion of ceramide into glucosylceramide, thereby reducing the substrate needed for creating complex glycosphingolipids.

During its January 2025 annual presentation, Sanofi shared that it expects to submit a regulatory application for venglustat in Fabry disease in 2026, and that Phase III trial results are anticipated in the second half of 2025.

The anticipated launch of these emerging Fabry disease drugs are poised to transform the Fabry disease market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the Fabry disease market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about Fabry disease clinical trials, visit @ Fabry Disease Pipeline Market

The Fabry disease market dynamics are anticipated to change in the coming years. ERT such as FABRAZYME and REPLAGAL, provides patients with a synthetic version of the missing enzyme to manage symptoms and reduce organ damage, and with improved genetic testing and newborn screening programs enabling earlier diagnosis particularly in at-risk populations patients can begin ERT sooner, enhancing quality of life and life expectancy; meanwhile, ongoing research into advanced treatments like gene therapy, which aims to provide a permanent cure by introducing a functional α-Gal A gene, as well as small molecule therapies and substrate reduction therapies (SRT) like venglustat and lucerastat, offers promising alternatives and adjunct options that could further improve patient outcomes globally.

Furthermore, many potential therapies are being investigated for the treatment of Fabry disease, and it is safe to predict that the treatment space will significantly impact the Fabry disease market during the forecast period. Moreover, the anticipated introduction of emerging therapies with improved efficacy and a further improvement in the diagnosis rate is expected to drive the growth of the Fabry disease market in the 7MM.

However, several factors may impede the growth of the Fabry disease market. Fabry disease presents with highly variable symptoms across individuals, often leading to misdiagnosis or delayed diagnosis particularly in milder cases complicating the establishment of standardized care protocols; this variability, combined with genetic diversity, makes personalized treatment challenging, as therapies like GALAFOLD are only effective for patients with amenable mutations, limiting their applicability, while the high cost of treatments such as ERT, GALAFOLD, and potential gene therapies further restricts access, especially in regions with limited healthcare resources, ultimately resulting in poorer patient outcomes.

Moreover, Fabry disease treatment poses a significant economic burden and disrupts patients’ overall well-being and QOL. Furthermore, the Fabry disease market growth may be offset by failures and discontinuation of emerging therapies, unaffordable pricing, market access and reimbursement issues, and a shortage of healthcare specialists. In addition, the undiagnosed, unreported cases and the unawareness about the disease may also impact the Fabry disease market growth.

| Fabry Disease Report Metrics | Details |

| Study Period | 2020–2034 |

| Fabry Disease Report Coverage | 7MM [The United States, the EU-4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| Fabry Disease Market Size in 2024 | USD 1.7 Billion |

| Key Fabry Disease Companies | Amicus Therapeutics, CHIESI Farmaceutici, Protalix Biotherapeutics, Takeda Pharmaceuticals, Idorsia Pharmaceuticals, Sanofi, Sangamo Therapeutics, UniQure Biopharma, 4D Molecular Therapeutics, and others |

| Key Fabry Disease Therapies | GALAFOLD (migalastat), ELFABRIO (PRX-102/pegunigalsidase alfa-Iwxj), FABRAZYME (agalsidase beta), REPLAGAL (agalsidase alfa), Lucerastat, Venglustat (GZ402671), Isaralgagene civaparvovec (ST-920), AMT-191, 4D-310, and others |

Scope of the Fabry Disease Market Report

- Fabry Disease Therapeutic Assessment: Fabry Disease current marketed and emerging therapies

- Fabry Disease Market Dynamics: Conjoint Analysis of Emerging Fabry Disease Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Fabry Disease Market Access and Reimbursement

Discover more about Fabry disease drugs in development @ Fabry Disease Clinical Trials

Table of Contents

| 1 | Key Insights |

| 2 | Report Introduction |

| 3 | Executive Summary |

| 4 | Key Events |

| 5 | Epidemiology and Market Forecast Methodology of Fabry Disease |

| 6 | Fabry Disease Market Overview at a Glance |

| 6.1 | Market Share (%) Distribution by Therapies of Fabry Disease in 2024 |

| 6.2 | Market Share (%) Distribution by Therapies of Fabry Disease in 2034 |

| 7 | Disease Background and Overview |

| 7.1 | Introduction |

| 7.2 | Phenotypic Variability |

| 7.3 | Inheritance Related to Fabry Disease |

| 7.4 | Pathophysiology |

| 7.5 | Inflammation in Fabry Disease |

| 7.6 | Molecular Mechanisms of Fabry Disease |

| 7.7 | Classical Manifestations in Fabry Disease According to Age |

| 7.8 | Diagnostic Evaluation of Fabry Disease |

| 7.8.1 | Biomarkers Related to Fabry Disease |

| 7.8.2 | Newborn Screening (NBS) for Fabry Disease in the World |

| 7.8.3 | Diagnosis Algorithm |

| 7.9 | Treatment and Management for Fabry Disease |

| 7.9.1 | Treatment and Management Algorithm |

| 7.1 | Prognosis of Fabry Disease |

| 7.11 | Diseases Involvement in Fabry Disease |

| 7.11.1 | Renal Involvement in Fabry Disease |

| 7.11.2 | Neurological Involvement in Fabry Disease |

| 7.11.3 | Cardiovascular Involvement in Fabry Disease |

| 7.11.4 | Other Disease Manifestations and Quality of Life |

| 7.12 | Guidelines, Recommendations, and Management for Fabry Disease |

| 7.12.1 | Orphanet Journal of Rare Diseases (2015) |

| 7.12.2 | HSE Guidelines for the Treatment of Fabry Disease (2024) |

| 7.12.3 | An Expert Consensus on Practical Clinical Recommendations and Guidance for Patients With Classic Fabry Disease (2022) |

| 7.12.4 | Clinical Management of Female Patients With Fabry Disease Based on Expert Consensus (2025) |

| 7.12.5 | Management and Treatment Recommendations for Adult Patients (2018) |

| 7.12.6 | Screening, Diagnosis, and Management of Patients With Fabry Disease: Conclusions From a ‘Kidney Disease: Improving Global Outcomes’ (KDIGO) Controversies Conference (2017) |

| 7.12.7 | Consensus Recommendations for Diagnosis, Management, and Treatment of Fabry Disease in Pediatric Patients (2019) |

| 8 | Epidemiology and Patient Population of Fabry disease in the 7MM |

| 8.1 | Key Findings |

| 8.2 | Assumptions and Rationales: 7MM |

| 8.3 | Total Diagnosed Prevalent Cases of Fabry Disease in the 7MM |

| 8.4 | The United States |

| 8.4.1 | Total Diagnosed Prevalent Cases of Fabry Disease in the United States |

| 8.4.2 | Gender-specific Diagnosed Prevalent Cases of Fabry Disease in the United States |

| 8.4.3 | Age-specific Diagnosed Prevalent Cases of Fabry Disease in the United States |

| 8.4.4 | Phenotype-specific Diagnosed Prevalent Cases of Fabry Disease in the United States |

| 8.5 | EU4 and the UK |

| 8.5.1 | Total Diagnosed Prevalent Cases of Fabry Disease in EU4 and the UK |

| 8.5.2 | Gender-specific Diagnosed Prevalent Cases of Fabry Disease in EU4 and the UK |

| 8.5.3 | Age-specific Diagnosed Prevalent Cases of Fabry Disease in EU4 and the UK |

| 8.5.4 | Phenotype-specific Diagnosed Prevalent Cases of Fabry Disease in EU4 and the UK |

| 8.6 | Japan |

| 8.6.1 | Total Diagnosed Prevalent Cases of Fabry Disease in Japan |

| 8.6.2 | Gender-specific Diagnosed Prevalent Cases of Fabry Disease in Japan |

| 8.6.3 | Age-specific Diagnosed Prevalent Cases of Fabry Disease in Japan |

| 8.6.4 | Phenotype-specific Diagnosed Prevalent Cases of Fabry Disease in Japan |

| 9 | Patient Journey of Fabry Disease |

| 10 | Marketed Therapies of Fabry Disease |

| 10.1 | Key Competitors |

| 10.2 | GALAFOLD (migalastat): Amicus Therapeutics |

| 10.2.1 | Product Description |

| 10.2.2 | Regulatory Milestones |

| 10.2.3 | Other Development Activities |

| 10.2.4 | Clinical Development |

| 10.2.4.1 | Clinical Trial Information |

| 10.2.5 | Safety and Efficacy |

| 10.2.6 | Analyst View |

| 10.3 | ELFABRIO (PRX-102/pegunigalsidase alfa-Iwxj): CHIESI Farmaceutici and Protalix Biotherapeutics |

| 10.3.1 | Product Description |

| 10.3.2 | Regulatory Milestones |

| 10.3.3 | Other Development Activities |

| 10.3.4 | Clinical Development |

| 10.3.4.1 | Clinical Trial Information |

| 10.3.5 | Safety and Efficacy |

| 10.3.6 | Analyst View |

| 10.4 | FABRAZYME (agalsidase beta): Sanofi (Genzyme) |

| 10.4.1 | Product Description |

| 10.4.2 | Regulatory Milestones |

| 10.4.3 | Other Development Activities |

| 10.4.4 | Safety and Efficacy |

| 10.4.5 | Analyst View |

| 10.5 | REPLAGAL (agalsidase alfa): Takeda Pharmaceuticals |

| 10.5.1 | Product Description |

| 10.5.2 | Regulatory Milestones |

| 10.5.3 | Other Development Activities |

| 10.5.4 | Safety and Efficacy |

| 10.5.5 | Analyst View |

| 11 | Emerging Therapies of Fabry Disease |

| 11.1 | Key Cross Competition |

| 11.2 | Lucerastat: Idorsia Pharmaceuticals |

| 11.2.1 | Product Description |

| 11.2.2 | Other Development Activity |

| 11.2.3 | Clinical Development |

| 11.2.3.1 | Clinical Trial Information |

| 11.2.4 | Safety and Efficacy |

| 11.2.5 | Analyst View |

| 11.3 | Venglustat (GZ402671): Sanofi |

| 11.3.1 | Product Description |

| 11.3.2 | Other Development Activity |

| 11.3.3 | Clinical Development |

| 11.3.3.1 | Clinical Trial Information |

| 11.3.4 | Safety and Efficacy |

| 11.3.5 | Analyst View |

| 11.4 | Isaralgagene civaparvovec (ST-920): Sangamo Therapeutics |

| 11.4.1 | Product Description |

| 11.4.2 | Other Development Activity |

| 11.4.3 | Clinical Development |

| 11.4.3.1 | Clinical Trial Information |

| 11.4.4 | Safety and Efficacy |

| 11.4.5 | Analyst View |

| 11.5 | AMT-191: UniQure Biopharma |

| 11.5.1 | Product Description |

| 11.5.2 | Other Development Activity |

| 11.5.3 | Clinical Development |

| 11.5.3.1 | Clinical Trial Information |

| 11.5.4 | Analyst View |

| 11.6 | 4D-310: 4D Molecular Therapeutics |

| 11.6.1 | Product Description |

| 11.6.2 | Other Development Activity |

| 11.6.3 | Clinical Development |

| 11.6.3.1 | Clinical Trial Information |

| 11.6.4 | Safety and Efficacy |

| 11.6.5 | Analyst View |

| 12 | Fabry disease: 7MM Analysis |

| 12.1 | Key Findings |

| 12.2 | Market Outlook of Fabry Disease |

| 12.3 | Key Market Forecast Assumptions of Fabry Disease |

| 12.3.1 | Cost Assumptions and Rebates |

| 12.3.2 | Pricing Trends |

| 12.3.3 | Analogue Assessment |

| 12.3.4 | Launch Year and Therapy Uptakes |

| 12.4 | Conjoint Analysis of Fabry Disease |

| 12.5 | Total Market Size of Fabry Disease in the 7MM |

| 12.6 | Market Size of Fabry Disease by Therapies in 7MM |

| 12.7 | The United States Market Size |

| 12.7.1 | Total Market Size of Fabry Disease in the United States |

| 12.7.2 | Market Size of Fabry Disease by Therapies in the United States |

| 12.8 | EU4 and the UK Market Size |

| 12.8.1 | Total Market Size of Fabry Disease in EU4 and the UK |

| 12.8.2 | Market Size of Fabry Disease by Therapies in EU4 and the UK |

| 12.9 | Japan |

| 12.9.1 | Total Market Size of Fabry Disease in Japan |

| 12.9.2 | Market Size of Fabry Disease by Therapies in Japan |

| 13 | Unmet Needs of Fabry Disease |

| 14 | SWOT Analysis of Fabry Disease |

| 15 | KOL Views of Fabry Disease |

| 16 | Market Access and Reimbursement |

| 16.1 | United States |

| 16.1.1 | Centre for Medicare and Medicaid Services (CMS) |

| 16.2 | EU4 and the UK |

| 16.2.1 | Germany |

| 16.2.2 | France |

| 16.2.3 | Italy |

| 16.2.4 | Spain |

| 16.2.5 | United Kingdom |

| 16.3 | Japan |

| 16.3.1 | MHLW |

| 16.4 | Market Access and Reimbursement of Fabry Disease |

| 17 | Appendix |

| 17.1 | Bibliography |

| 17.2 | Report Methodology |

| 18 | DelveInsight Capabilities |

| 19 | Disclaimer |

| 20 | About DelveInsight |

Related Reports

Fabry Disease Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key Fabry disease companies, including Idorsia Pharmaceuticals, Protalix, Sanofi Genzyme, Sangamo Therapeutics, 4D Molecular Therapeutics, Resverlogix Corp, AVROBIO, Freeline Therapeutics, Ozmosis Research Inc., CellGenTech, Inc., uniQure, Codexis, Canbridge, Eleva GmbH, MP6 Therapeutics, Amicus Therapeutics, Sigilon Therapeutics, among others.

Fabry Disease Epidemiology Forecast

Fabry Disease Epidemiology Forecast – 2034 report delivers an in-depth understanding of the disease, historical and forecasted Fabry disease epidemiology in the 7MM, i.e., the United States, EU5 (Germany, Spain, Italy, France, and the United Kingdom), and Japan.

Cushing’s Disease Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key Cushing’s disease companies including Xeris Pharmaceuticals, Recordati, Corcept Therapeutics, Sparrow Pharmaceuticals, H. Lundbeck, Stero Therapeutics, Crinetics Pharmaceuticals, among others.

Crohn’s Disease Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key Crohn’s disease companies including Takeda Pharmaceutical, Janssen Pharmaceuticals, UCB, Biogen, AbbVie, AstraZeneca, Tillotts Pharma (Zeria Pharmaceutical), Gilead Sciences, Galapagos NV, Boehringer Ingelheim, Celgene (Bristol Myers Squibb), Eli Lilly and Company, RedHill Biopharma, Arena Pharmaceuticals, Mesoblast, among others.

Crohn’s Disease Pipeline Insight – 2025 report provides comprehensive insights about the pipeline landscape, pipeline drug profiles, including clinical and non-clinical stage products, and the key Crohn’s disease companies, including Anssen, RedHill Biopharma, Amgen, Pfizer, Prometheus Biosciences, AgomAb Therapeutics, Hoffmann-La Roche, Gilead Sciences, Eli Lilly and Company, Celgene, AstraZeneca, Mesoblast, Alfasigma, Tiziana Life Sciences, Abivax, Arena Pharmaceuticals, Cytocom, HAV Vaccines Ltd, Enzo Biochem Inc., Stero Biotechs, Reistone Biopharma Company Limited, Qu Biologics, Pfizer, Mitsubishi Tanabe Pharma Corporation, Takeda Pharmaceuticals, Soligenix, Immunic, Pfizer, Atlantic Healthcare, 4D Pharma, Landos Biopharma, Janssen, Roche, Eisai, Bristol-Myers Squibb, among others.

DelveInsight’s Pharma Competitive Intelligence Service: Through its CI solutions, DelveInsight provides its clients with real-time and actionable intelligence on their competitors and markets of interest to keep them stay ahead of the competition by providing insights into the latest therapeutic area-specific/indication-specific market trends, in emerging drugs, and competitive strategies. These services are tailored to the specific needs of each client and are delivered through a combination of reports, dashboards, and interactive presentations, enabling clients to make informed decisions, mitigate risks, and identify opportunities for growth and expansion.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.